Published: 04/06/2020

and written by P Smith

Most British people are clueless as to the amount they spend on monthly subscriptions, with the average person believing they spend around £29 each month, a study by Freeview has found that the actual figure is in most cases five times that amount averaging at £149. With nearly a fifth of people never reviewing their subscriptions and more than a quarter of them continuing to pay for subscriptions without realising prices had increased. Companies are fully aware of this and use it as a marketing trap, taking advantage of people’s lazy nature. Half of consumers are currently paying for at least one subscription service that they either do not use or get value for money from, according to the latest instalment of the ‘Forgotten Subscriptions Index’ from TopCashback.

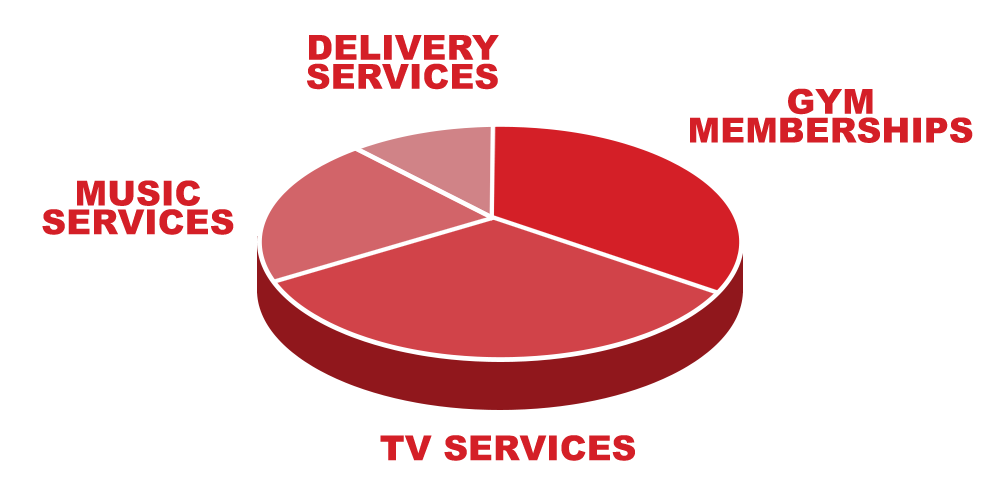

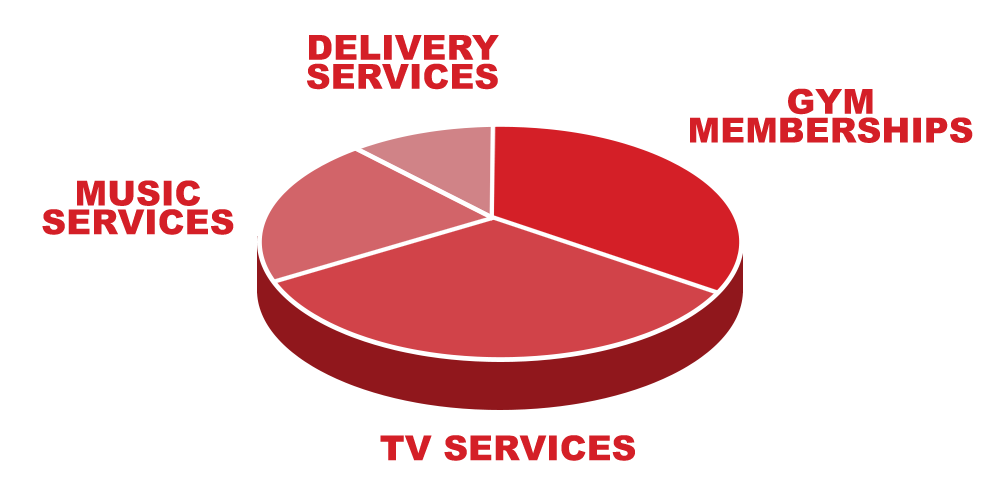

The most unused subscriptions include gym and fitness memberships (33%), TV streaming services (29%), music streaming plans (21%), and product delivery services such as Amazon Prime (11%).

The main reason people continue to pay for subscriptions that provide little value for money is that they feel that they will still get use from them at some point in the future. Another common reason for hanging on to subscriptions is ‘FOMO’ (the Fear of Missing Out). One in 10 avoid cancelling so they are kept in the loop about the latest shows on the likes of Netflix, Sky, Now TV, and Amazon Prime. To help you save money on your subscription Mr Lender has come up with several tips and tricks.

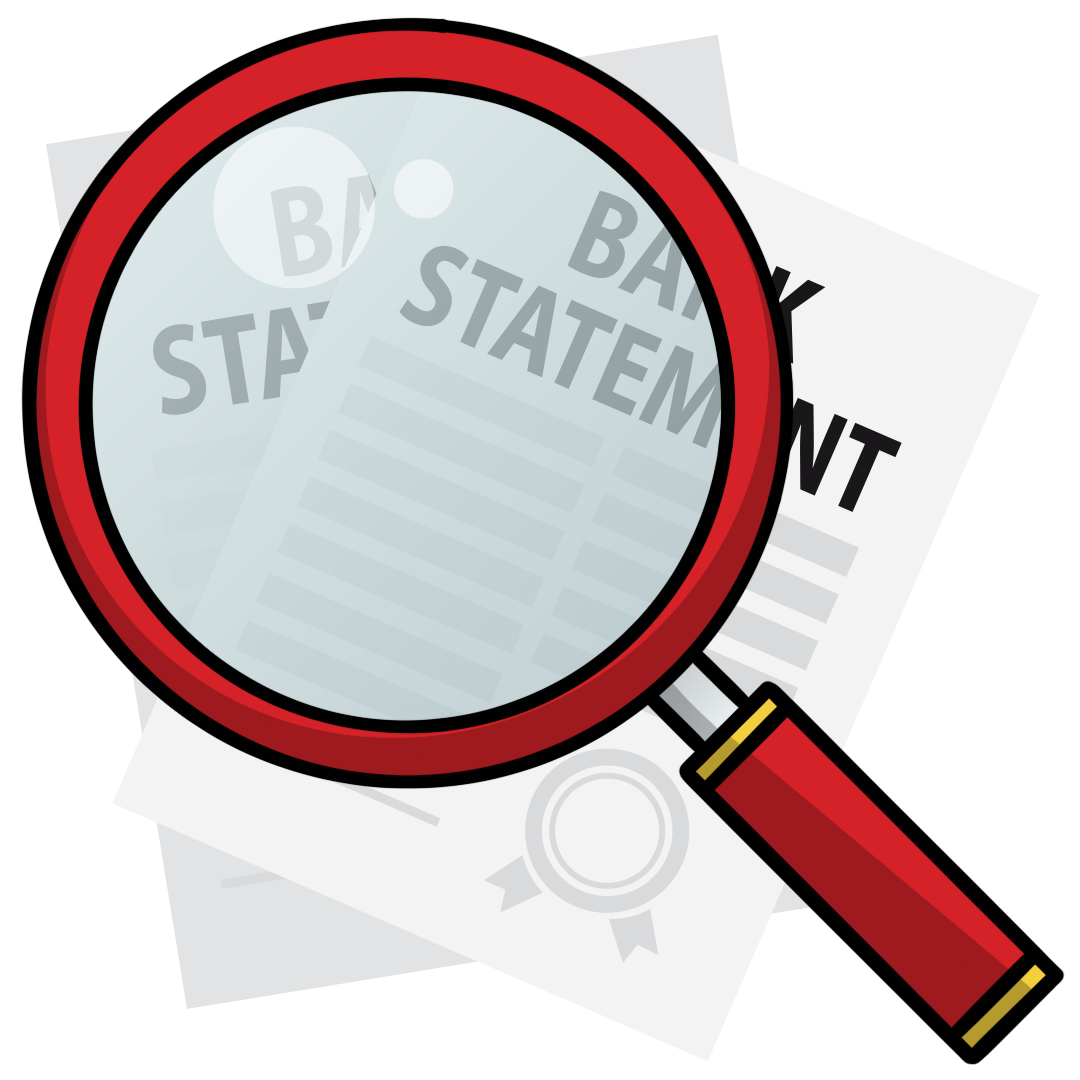

SEE ALL YOUR SUBSCRIPTIONS

The first thing you should do before anything is get to grips with all the services you currently pay for. Print out your monthly statements and go through and highlight all of the monthly subscription services you pay out for and how much you pay into them. From here you will be able to make some decisions, and you need to be realistic about whether you’re getting the best value for money from the service you’re receiving. When was the last time you used the service? Are you using it enough to warrant the cost? Can you still afford the monthly payments? Are there cheaper alternatives? If you feel like you’re not getting value for money, you’re better off ditching it. If you are hesitant to cancel certain things as you feel it’s something you’re looking to get back in to in the near future but not currently getting the most out of the service, then do some research and look to see if they offer a pay-as-you-go plan instead.

|

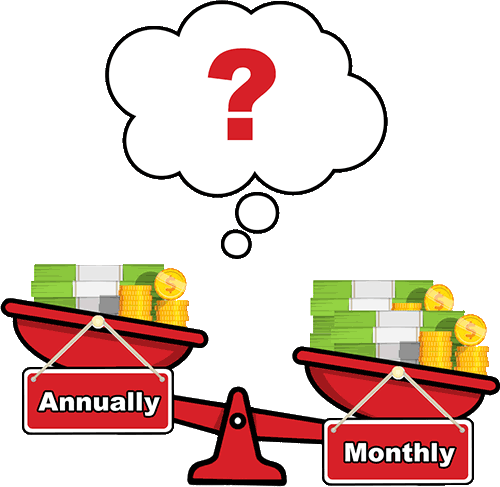

PAY ANNUALLY WHEN YOU CAN

The thought of having to pay a large upfront cost will obviously dissuade most people compared to the easily accessible monthly cost of a subscription. But if you have the funds available, it’s often worth paying for subscriptions you know you need and use regularly upfront for a year. Most places will give you a discount for signing up for longer periods of time as it ensures a steady revenue for the business, and you’re not constantly paying the added interest payments on top like with a monthly subscription. In a lot of cases, you get rewarded with extra features when paying annually. Gyms give you extra features like health follow up sessions, bespoke exercise plans, sessions with on-site experts and access to certain classes for free. An area in which we found this extremely beneficial is with magazine subscriptions. If you subscribe to the National Geographic you have to pay £6.99 a month for the magazine. An annual subscription through WHSmiths costs £33, Giving you a saving of £50 a year. |

HAGGLE

If you feel you’re paying too much, or the service you’ve received hasn’t been great, or that you’re just coming to the end of a contract, then speak to the company directly to ask for a discount. A survey conducted by “Which?” showed that 86% of customers who haggled over their broadband and pay-TV deals saved roughly £200 a year. 77% of customers that haggled over their mobile phone service ended up saving on average £70. Here are a few tips to help you get the most out of your subscription when haggling…

– Time your haggle right, never do it halfway through a contract as you have to pay a cancellation fee.

– Make sure you are speaking to someone who can offer you a better deal.

– Sellers aren’t obliged to cut the price of their products, so be polite.

– Show genuine interest, sales staff are more willing to cut the price of a one-off purchase if you suggest you’re ready to buy the item or service there and then.

– Be flexible.

– And don’t be afraid to walk away if you haven’t been offered a satisfactory deal.

|

SWITCH UP YOUR CONTRACT

If you’re not happy with the service you are being provided with for your phone, broadband or TV services and are looking to switch then make sure you follow these rules. The first thing you should do is check that you are eligible to switch up your contract, if you are still midway through a contract then providers usually charge extortionate cancellation fees. Then take note of what the key features are that you want in your new contract, there are tons of providers out there, each offering something a little different for a slightly different price. When you want to switch, always use a price comparison site to see what the options are in your area, and which one will give you the best deal. Look for bundles, so this way you’re not only saving money on your internet but also your phone and TV all rolled into one tidy cost effective package. But always talk to your provider, tell them you’re not happy with the service you have been receiving, and that you are looking to go elsewhere. More often than not they will try to match other offers or give you a better one, at the end of the day they still want you as there customer.

|

FREE TRIALS

If you’re offered something for free, you’ll probably wonder what the catch is – and with free trials that’s a wise move. The whole reason these trials are offered is to hook customers in and get them to pay for a service or product month after month. A large chunk of these companies’ business model is based on people failing to cancel their trial and automatically roll into a monthly subscription. A lot of the time they make it so you have to cancel a few days prior to when the trial expires. Some of the rules you should follow when doing a free trial are…

– Know when you have to cancel the free trial by.

– Check how to cancel and that you have done EVERYTHING they ask for.

– Time the trial to when you’re going to get the most from it.

– Don’t take multiple free trials at the same time.

– Check to see if you’re allowed another free trial after a certain period of time has passed.

|

FAMILY PHONE PLANS

Family plans or shared plans allow you to link anywhere between two and 20 different mobile contracts to one account. This means there’s just one bill to pay and one payment coming out of your bank account each month. How much you can save differs between networks.

– BT Mobile, you’ll save at least £3.50 per month, although this increases the more Sims you choose and when you add larger data amounts.

– EE knocks 10% of the cost of each additional contract you add to your family

– Vodafone offers a 15% discount for each additional contract you add to your family

– O2 gives you 10% for the first additional line you take out on a family plan. This increases by 10% for each additional line you add (the maximum discount is capped at 40% even though you can add up to 20 new lines).

– Virgin Media offers a discount of £2 for every month for each extra contract you add to your family plan (up to a maximum of four).

There are plenty of other extra features that get thrown into these packages, including…

– Share data allowance from one of the mobile contracts in the shared plan with others.

– Family SIM free access to thousands of wifi hotspots around the world.

– Unlimited calls between the different family sims.

|

|

Mr Lender is a multi-award winning lender and is rated five stars on Trustpilot by customer reviews. So why would you choose anyone else for your short term loans?